If you are thinking of selling your house soon, or even just refinancing, you may be wondering how much you can get for it. Thankfully, these days it’s not too difficult to get a good estimate of the value of your home – there are several ways to do it, and many are usually free.

Here are four ways to find out how much your house is worth, listed roughly from the quickest (and perhaps somewhat less accurate), to the more involved and most accurate:

1. Use an online automated home value estimation tool. The fastest and easiest way to get a rough estimate of your home’s value is to go to a website like Zillow or Realtor.com and enter your address. These sites will give you a free estimate of the current market value of your home, as well as how it compares to other listed and sold homes in your neighborhood, and the trends over time. If you live in a more rural area (like Brenham, Texas, where we are located!), there may not be enough data for these estimates to work well.

2. Run your own comparable sale analysis. Since the value of a house is primarily determined by what buyers in the market are willing to pay for it, you can get a good sense of what your house is worth by looking at what similar properties recently sold for. This is called a comparable sale or “comp” analysis. You can again use Zillow or Realtor.com (we also like Compass!), this time to browse houses that have recently sold. Run a property search with criteria similar to your house, but change the listing status to “Sold” (on Compass, this is under “Filters”).

You may have to expand the criteria a little bit if you don’t get enough results. You are not likely to find several other houses exactly like yours, so you will need to account for the factors that differ between your house and the comps you find, and adjust the value accordingly. Some factors to look out for in each comparable property are:

- Size (sqft) – pay close attention to the “price per square feet,” as this is a good general gauge for how to value homes in your area!

- Number of bedrooms and bathrooms

- Location – you want to choose comps that are as close to your house as possible, but if you need to move further out, you may have to adjust for whether the comp is in a more or less desirable location

- Condition – does the comp have more or fewer upgrades than your house? Does it seem to need more or fewer repairs?

- Extras – garage, yard, etc

There are other factors to consider but these should give you a really good start! For each comp you find, adjust the price up or down for each factor according to whether your house scores better or worse.Note that some states (like Texas) are non-disclosure states, so the actual prices that homes have sold for are not publicly available. You can use the last price a property was listed for as a good approximation. If the house sold quickly (i.e., low “days on market” / “time on zillow”), then you can be pretty confident it sold at or above the list price. If the house sold more slowly, however, it’s likely that the final sold price was below the list price.

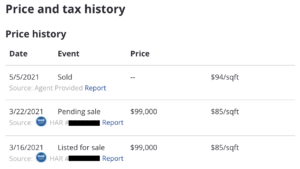

(Side note: we have noticed that in zillow’s “price history” table for recently sold houses in Texas, it often lists a price per square foot at the time the house was listed, and sometimes even for the sale! Could this be a non-disclosure “loop-hole” and a way to deduce the actual sold price? Who knows!)

3. Ask a real estate agent. If running your own comparable sale analysis sounds like too much effort and uncertainty, you can always just ask an agent for help! Find an agent with lots of experience working in your market, and they should know local home values like the back of your hand. They will probably be happy to help you determine the value of your home for no charge in the hopes that if you decide to list it, they will be the first one you call (and make sure that they are!). They will also have first hand access to the most up-to-date data on comparable sales, and in-depth knowledge of how much each of the different factors discussed above affect the value of a home.

Note that some agents or brokerages might formalize this process and offer the service of what’s called a “Broker Price Opinion” (or BPO) on the value of a property, usually for a small fee. You could go that route if you are uncomfortable asking an agent to do a comp analysis for you (e.g. if you are not thinking of selling soon). The exact service and fee will vary according to local regulations.

4. Hire an appraiser. If you want the most comprehensive assessment of the value of your home and are willing to pay a little bit for it, you can always hire a professional appraiser. These are the people that work with lenders during the purchase or refinance process to determine the value of a given home (and in turn, the amount the bank is willing to lend), but any individual can hire them at other times as well. A professional appraisal on a house usually costs anywhere from $500 to $700, and will come with a very thorough report of the factors influencing the value of the house. You could call your local bank and ask what appraisers they recommend, or search online.

We hope this helps you get a sense of different ways for determining the value of your home!

If you have a house in Brenham, Texas or the surrounding areas that you are thinking of selling and aren’t sure how much it’s worth, we would be happy to speak with you and make you a cash offer! Call us at (979) 476-8240 or visit our Contact Page